How to Invest Money on an Irregular income – The Freelance Lifestyle Part 1

How to Invest Money on an Irregular income –

The Freelance Lifestyle Part 1

This is a 2-part finance mastery series for entrepreneurs

Have you been enjoying life as a freelancer with all perks of working from anywhere and anytime? Despite the benefits and freedom, an irregular income can pose challenges. If you want to build a stable business, oftentimes, freelancers don’t have a background in finance and have never learned the principles of wealth creation.

In Part I of the Finance Mastery Series, we’ll address step 1 through 3 how to “Crack The Wealth Code” on an irregular income AKA “The Freelance Lifestyle”

Financial management is about creating a strategy that you can follow. Next to life’s necessities, debt management, and lifestyle, it’s critical to keep your monthly savings and investments in mind if you want to be wealthy in the foreseeable future. As a freelancer, you are responsible for creating your own financial security that can ensure an abundant life and retirement without worrying, despite an irregular income.

There are six critical steps to follow that allow you to live life on your terms. Your financial future depends on how you address your individual circumstances. While there’s no one-size-fits-all master plan, there are core principles that can be adjusted to anyone’s needs.

Understanding your particular financial needs begins with understanding these six steps to financial independence…

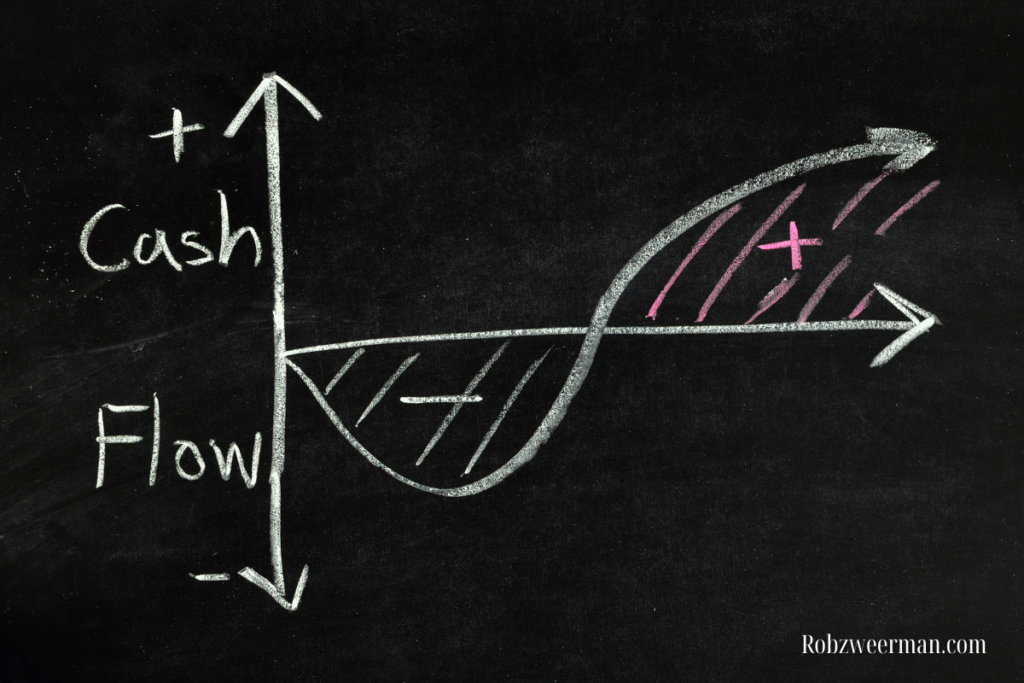

Step #1 Generating More Cash Flow and Additional Income

As a freelancer, you set your own prices and collect payments. This means you have to record your profit religiously, your expenses, and income tax. Tracking your finances daily can be overwhelming at first; however, forming this habit early on will benefit you and can prevent you from hitting financial rock-bottom later on.

Remember: your cash flow is your liquid income after all expenses paid.

As a freelancer, consider creating multiple streams of income (MSI’s) in your business to increase cash flow and income predictability:

- Client retainers (biweekly or monthly)

- Hourly-based (also possible as a retainer, where clients can purchase hours upfront)

- Project-based (part of the payment should be upfront, rest upon delivery)

- Royalties (content)

- Evergreen products (ex. A video course that keeps generating sales, but the work is done only once)

- Joining a network marketing business that allows you to create passive income through building a team around you

- Investing in asset classes that generate a healthy rate of return consistently while it’s guaranteed that you investment won’t lose any money.

Generating additional income is the key to wealth.

Saving your way to wealth mathematically is not possible. Even if you piled cash under your mattress, you’d lose your hard-earned dollars against inflation. A way to increase cash flow as a freelancer is to create product retainers for clients while simultaneously getting paid hourly or per-project basis. Although you can take on fewer clients this way, it will allow you to predict more potential revenue in your business. If you want to continue charging hourly or per project-basis, consider asking part of the money upfront – that way, it will allow you to choose how you distribute your income, and therefore keeping more cash flow in your pocket, allowing you to save or invest a portion.

Not sure what additional revenue streams you can create in your business? Schedule a clarity call with my team, and we will help you discover MSI’s (Multiple streams of income) in your life or business.

Step #2 Follow A Financial Strategy When Managing your Expenses

With a regular paycheck, you can develop a predictable budgeting system. However, as a freelancer, if you are dealing with a somewhat irregular income, it’s key that you learn how to “control the controllable”

While your bills and expenses are constant, your income is fluctuating.

Look at your past months to figure out what your likely expenses are; that way, you can make a somewhat accurate forecast of what next month is going to look like.

Once you track and map your baseline of recurring expenses accompanied by exact payment dates and prioritized them based on expenses you need “to survive” – i.e, rent, utilities, car payment, gas, childcare, groceries. Then map out your unnecessary expenses, the things you can likely part with, such as Netflix, sports entertainment channels, dining out, magazine subscriptions, etc – that will free up more cash flow.

Lastly, look at all outstanding debt like credit cards, student loan debt, a car loan, personal loan, and determine what your monthly payment on these should likely be like to lower revolving debt consistently.

Student loan debt and credit card debt are often at their highest when your cash flow

is at its lowest.

Living on a well defined budget with an implemented debt elimination strategy is the first step towards financial freedom.

Unsure how to map monthly expenses or create a lifestyle budget as a freelancer? Apply for a complimentary Financial Needs Assessment with one of our licensed financial strategists to discover how to design a debt elimination plan.

The best way to approach debt is to create a debt hierarchy which works as follows. Rank debt based on the highest interest rate because compounded interest can work in your favor or be your downfall in paid interest in the long run.

Pay off the debt with the highest interest rate first.

Establishing a budget, sticking to it, managing your expenses, and increasing cash flow is the path towards financial freedom.

Do you want to learn how this all unfolds in reality, this is your chance to grab a free seat for my next masterclass on how to crack the wealth code and how you can build out your own 360-degree wealth blueprint.

Step #3 Building an Emergency Fund

After you have tackled steps #1 and 2, it’s time to start thinking of setting up an emergency saving goal. Especially as a freelancer, you’re much more vulnerable to changes within the economy than someone with a corporate job. Therefore, you need to prepare yourself not just for sudden economic changes but also for potential losses. Having an emergency fund saved gives you peace of mind when sudden changes occur.

Your emergency fund should include enough to cover three months’ worth of expenses.

Tip: Open a high yield saving account (2 % yield or more), so you will earn additional interest on these savings while not using those funds.

Next, develop a saving goal in terms of a dollar amount. If your income is irregular, set aside a percentage rather than a fixed amount. To get started, set aside anywhere from 10-15 % of your monthly cash flow, and move these funds into your “high yield emergency fund”.

Tip: If you can set up an automatic transfer, from your checking to your savings, even better.

If your current finances don’t permit you to set aside 10 to 15 %, try to find additional ways of earning extra income. Whether it’s developing products that have the potential to generate passive income or build a side hustle: instead of lowering your means, find ways to maximize your income.

Consider reading: Why a Poor Mindset Won’t Make You Rich.

Eliminating debt and building an emergency fund are top priorities.

Most freelancers have a hard time developing a financial strategy and sticking to it. It’s easy to get side-tracked and lured into spending your hard-earned income uncontrollably. We are marketed products and services daily, and as human beings we all have an instinctual need for comfort, satisfying our craving; however, developing financial discipline now will provide you a worry-free, and potentially financially free life in the long term.

Environment plays a role in developing financial habits. Tip: Creating visible reminders of your goal can help you stay focused and maintain motivation. Remember why you do it?

Do you need help building a personalized wealth blueprint? I invite you to apply for our inner-circle program to shape your vision and financial clarity. We offer 7-days completely for free, because we are serious about financial training.

In Part II of the Finance Mastery Series, we will dive deeper into “How to Crack The Wealth Code” and discuss Steps #4 to #6 that will give you a full 360 degree game-plan on how you can set yourself up to become wealthy, even on an irregular income.

Read more on the difference between Cash Flow and Revenue, so you won’t make the same mistakes that caused the downfall of many businesses in 2020.

Want to save this for later? Pins these graphics on Pinterest!

ABOUT THE AUTHOR

Team Rob N. Zweerman

Rob Zweerman shares his expertise on how to achieve financial well-being through his online webinars, podcast, training events, coaching, and mastermind programs. He is the founder of various media and financial education companies. Rob Zweerman continuously seeks out to elevate his own wealth performance by surrounding himself with the industry’s best teachers and mentors that in turn, drives the results of his clients.

Commercial Real Estate Investing

How to Get Started?

Want greater financial flexibility and personal freedom? Learn how to invest in commercial real estate with Rob Zweerman for every experience level and investing strategy.